529 college savings plan: 13 things parents need to know

Roshani Pandey is a financial advisor and founder of True Root Financial. True Root Financial is located in San Francisco, CA and serves clients across the globe.

Stanley is a business owner and Mia is a doctor. They have two daughters, Olivia and Ava. Even though Stanley and Mia put themselves through college and later graduate schools, like all parents, they want to give their daughters a head start in life that they didn’t have for themselves. With the help of their financial planner, they look into a 529 college savings plan to save and invest for the future.

Key takeaways

- A 529 College savings plan is a tax-advantaged method to save for college

- You can only use the funds for educational purposes; non-education related withdrawals are subject to taxes and a penalty

- Each state sponsors its own plan but you can choose a plan offered by any state

- If your state offers additional tax benefits and the plan is well-run, it is generally a good idea to go with your own state

- Other factors to consider are investment performance, risks, costs and the overall management of the plan

Free Resource

Before you continue reading, grab this handy 1-page guide to understand the kind of educational expenses you can use the 529 plan for. The guide also helps you calculate what part of the distribution, if any, is taxable. Download below.

1. Why save early for college?

According to College Board, since 2008, the cost of college has increased by over 25% for private colleges and almost 30% for public colleges. Today, the total annual cost of college at a private school is about $55K and that at a public school is about $27K. That means that for a four-year college degree, the total tab comes out to almost $220K for private schools and about $108K for public schools. 529 accounts can be an effective tax-advantaged saving strategy to pay for college.

2. What is a 529 college savings plan?

A 529 plan is a state-sponsored savings account for college. Its biggest advantage is its tax advantage. If Stanley and Mia were to open a 529 account for Olivia, they would be the owners and Olivia, the beneficiary. They would then, contribute after-tax dollars into the account. Let’s say they contributed $100K and over the years, the money grew to be $150K. Normally, they would have to pay taxes on the $50K. These would be capital gains taxes on any gains and income taxes on dividends and interest.

But in a 529 account, as long as the money is being used for a qualified educational expense, they don’t have to pay taxes. So, when Olivia starts going to college, they can use the entire $150K to pay her tuition, room and board, and books without paying any additional taxes.

In that sense, a 529 account is a lot like a ROTH IRA where your money grows tax-free and over the long-run, this tax-free growth can be powerful.

3. Who is eligible to open a 529 account?

Anyone who is a US citizen or a green-card holder and has a legal address in the US can open a 529 account. You can open it for anyone, including your children, grandchildren, niece or nephew.

4. Can a 529 account only be used for college by the beneficiary?

Stanley and Mia can also use the money in the 529 plan for Olivia’s K-12 private school for an amount of up to $10K per year. In 18 years, if Olivia gets a scholarship and doesn’t need the 529 plan money, she can still use it for graduate school.

Or, they can use it to pay for Olivia’s sister, Ava’s education by simply changing the beneficiary.

5. What happens to the 529 account if I don’t use it for educational purposes?

In that case, you have to pay taxes on the gains, plus a 10% penalty to the IRS. In the above example where Stanley and Mia put in $100K and the money grows to $150K in the 529 account, they would have to pay taxes on the $50K, plus a 10% penalty.

This is the main disadvantage of a 529 account. There is a penalty if you change your mind and decide to use the money for something other than education.

6. What are the different types of 529 accounts?

529 plans consist of a 529 college savings plan as described above and a prepaid tuition plan that lets you lock and prepay tuition for college. Unlike a 529 college savings plan, the prepaid plans are not as flexible and generally allow you to only pay tuition and not other expenses like books, room and board, etc.

If you have already put money in your child’s custodial account like a UTMA or other minor accounts, you can also use that money to fund a 529 UTMA account. In this case, the account owner is the child and the parent acts as the custodian for the minor. So generally, the money can only be used for the same child’s education. It cannot be easily transferred to a sibling’s 529.

7. Do I have to pick a 529 college savings account offered by my state?

While all 50 states offer a 529 account, you don’t have to pick one from your state. However, there may be additional tax advantages for picking your state’s 529 account.

8. What are the tax advantages of opening a 529 account with your state?

More than 30 states offer additional tax benefits for contributing to their 529 account. Some states like Washington state that do not have any state income taxes, also don’t have any state tax benefits, by virtue of being income tax free. California, on the other hand, has a high state income tax and yet, does not provide any state tax benefits for using a California 529 plan.

Stanley and Mia are residents of New York and they file their taxes jointly. Their contributions to a New York 529 plan would be tax-deductible for an amount of up to $10K for the couple or $5K per person. Since New York has one of the highest state taxes in the country, this tax deduction could be valuable.

Bonus tip:

Bonus tip:

Since the contribution to a 529 account is state tax-deductible, you could pay for your child’s K-12 education or an adult can pay for his/her own grad school by simply transferring money into a 529 account and immediately using it to pay for school expenses. This way, you get state tax deductions on your school expenses that you otherwise wouldn’t have. Some states don’t allow you to take advantage of this tax loophole by requiring you to keep money in the 529 account longer. Check your state’s requirements.

9. Do I have to open an account with my state to get any tax advantage?

Generally, in order to get any state income tax benefit, you have to open a 529 plan in the state that you are a resident of.

Currently, 7 states, named below, offer a tax advantage regardless of if you contribute to in-state or out-of-state 529 accounts.

As an example, if Stanley and Mia were Pennsylvania residents, they would get a state tax deduction of up to $30K for their contributions, regardless of if they opened a Pennsylvania 529 account or a non-Pennsylvania one. This figure gets revised yearly to account for inflation.

- Arizona

- Arkansas

- Kansas

- Minnesota

- Missouri

- Montana

- Pennsylvania

10. Who manages the 529 account?

The 529 plan of each state chooses asset managers to manage your accounts. You can purchase an account directly with the state or from your advisor as long as they are authorized to sell 529 accounts by the state.

New York has two accounts. One is a direct account managed by Vanguard. So, when you enroll in this account, you will also buy Vanguard mutual funds.

The other is an advisor offered account, managed by JP Morgan. When you enroll in this account, you will buy JP Morgan-advised funds.

11. What are my investment options?

Both the direct account and the advisor offered account generally have these investment options:

1. Age-based options where the manager of your portfolio shifts your portfolio automatically from a more aggressive to a more conservative portfolio as your child gets closer to going to college.

2. The second option is static investments. This could be a single mutual fund or a group of funds. However, the allocation to these funds don’t change automatically over time and it is up to you to make the changes.

12. How do age-based options work?

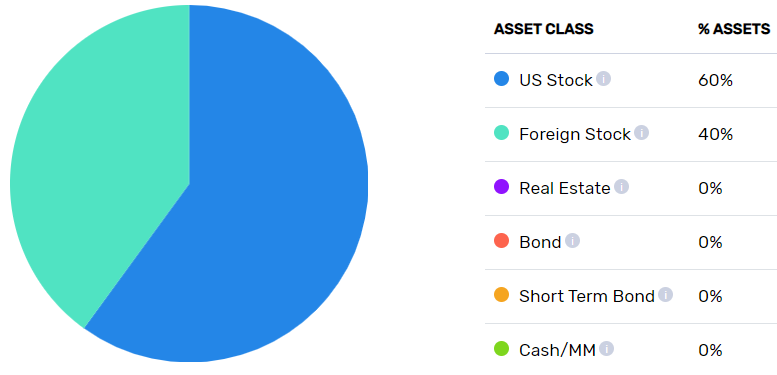

Under the age-based investment option, New York offers three different asset allocations: aggressive, moderate and conservative. If Stanley and Mia were to choose an aggressive age-based option when Olivia was first born, they would pick the portfolio for a child aged 0-4 years. At this time, their time horizon for the account is 18 years because that’s how long they have until Olivia needs the money for college. So, to give them the most return given the long time horizon, Vanguard invests in a 100% stock and 0% bond allocation, as shown below.

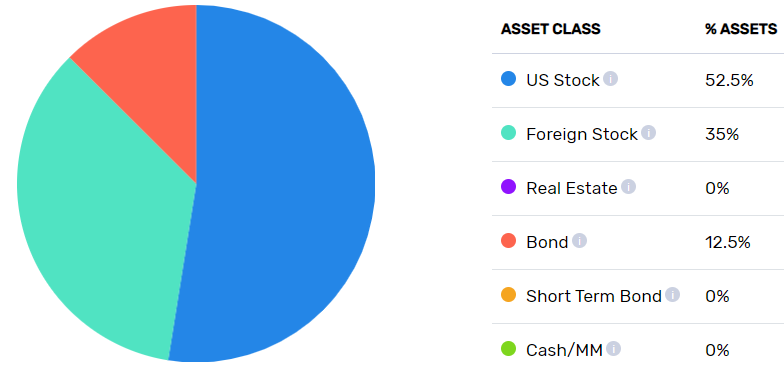

When Olivia turns 5-6 years old and gets closer to being college-age, her time horizon now decreases to 12-13 years. So, Vanguard makes the portfolio a little more conservative to ensure that the money is there when she is ready for college. Vanguard does this by automatically increasing the allocation to bonds and decreasing the allocation to stocks to bring it to 88% stocks and 12% bonds, as shown below.

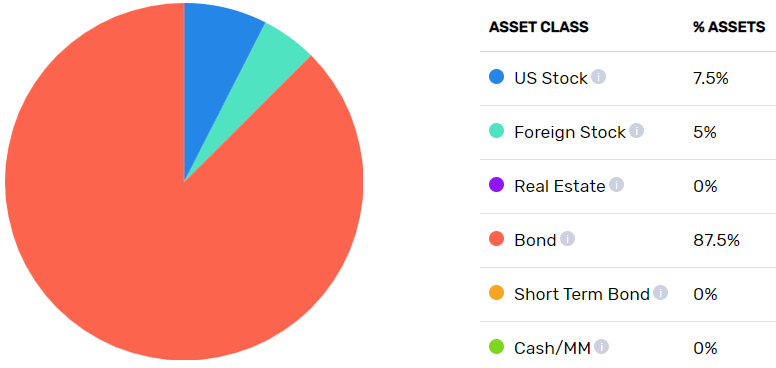

Even after she goes to college, the age-based option will continue to manage the portfolio. At that time, to make sure that she has the money as she needs it, most of the account is invested in bonds. But, there’s still a small sliver of about 13% in stocks to keep the portfolio growing, as shown below.

13. How do I choose a 529 accounts that’s right for me?

First, you have to decide if you want to open an account directly with the state or through an advisor. Savingforcollege.com is a great resource for 529 accounts. If you search for New York 529 accounts there, you will see both the direct and advisor offered programs.

If you have a financial advisor, they should be able to help you choose the plan and investments.

Once you decide if you want to go direct or through an advisor, compare your state’s account with those of others:

With the help of their financial planner, Stanley and Mia decide to go with a direct account. Given all the advantages, they also decide that an age-based investment option is best for them. They search for the best-rated plans on savingforcollege.com and compare their home state account with those of two other states:

| New York 529 college savings account | Nebraska Education Savings Trust | Fidelity Arizona College Savings account |

| Managed by Vanguard with all index funds. You can choose among conservative, moderate and aggressive age-based accounts | Managed by various active and index managers. You can choose among aggressive, growth and index age-based accounts | Managed by Fidelity with both active and index funds. You can choose among active, index and a blended portfolio with both active and index funds |

To compare the accounts, use these 4 criteria:

Performance

The actively managed 529 accounts offered by Arizona has the best performance, even after taking fees into account. But, the New York accounts are a close second.

| Fidelity Arizona College Savings account | New York 529 college savings account | Nebraska Education Savings Trust |

| 1st place: Fidelity Arizona actively managed fund has the best after-fee performance |

2nd place: New York account is a close second in terms of performance |

3rd place: Nebraska account stands in third place when compared with the other two accounts

|

Portfolio

All three accounts appropriately manage the risk and return of the portfolio by investing most of the portfolio in stocks at the beginning of the account and shifting to bonds as the student gets closer to college age.

Fees

The New York account is the clear winner here with the lowest fee. Fees can have a negative impact on performance, not just because you give up today’s dollars but you also give up all the compound returns your dollar makes over the next 18 years.

| New York 529 college savings account | Nebraska Education Savings Trust | Fidelity Arizona College Savings account |

| 1st place (lowest fee): 0.13% for all its direct 529 accounts | 2nd place (moderate fee): .32% to 0.44% | 2nd place (range of fees): .14% for the index fund to 0.94% for actively managed funds |

But, as long as the fund is beating its benchmark after fees, do we need to care about the fees? Yes, we do. At any point in time, we only know past performance. We don’t know what the future performance will be. However, we do know what the future fees will be. So, high fees will remain high but great performance might not necessarily hold up.

Tax savings

Since Stanley and Mia are New York residents, they get additional state tax benefits only if they invest in a New York account. As mentioned above, 7 other states provide these tax benefits regardless of if you open an account with the state or outside.

| New York 529 college savings account | Nebraska Education Savings Trust | Fidelity Arizona College Savings account |

| 1st place (most favorable for NY residents): State tax deductions on contributions of up to $10K | No state tax deductions for non-Nebraska residents | No state tax deductions for non-Arizona residents |

This is an important criterion but not the only one as tax savings count only in the year when you contribute and only for those amounts, whereas performance and fees are assessed on the account every year and on the entire portfolio.

What do Stanley and Mia do?

Given the performance of the New York funds, the low fees and the tax benefits, they decide to open a direct 529 account with New York. They consider their risk tolerance and pick the aggressive age-based investment option for both Olivia and Ava.

Next steps for you:

Once you are ready to open a college savings plan,

- Consult savingsforcollege.com to know your options and compare plans

- Check all your options but don’t overthink. Time is of the essence here because you want the account to start compounding early. So, open an account and start contributing money soon

- Consider contributing more than the state tax deduction limit early on so that your money grows for longer. Check any restrictions on annual contribution limits

- Encourage grand-parents and relatives to contribute to a 529 account, instead of giving other gifts to your children

Bonus tip:

Bonus tip:

Grandparents and relatives can also get state-tax deductions by opening and contributing to a 529 account for your child.

Leave a Reply

Want to join the discussion?Feel free to contribute!