How to choose funds in your 401K?

Roshani Pandey is a financial advisor and founder of True Root Financial. True Root Financial is located in San Francisco, CA and serves clients across the globe.

Last week, a friend of mine asked me the following question about how to choose funds in his 401K. Sam is the founder of a successful tech company that processes payments for overseas transactions:

Question:

Hi Roshani! Finally, setup 401k for our company. Any advice on how to choose funds to invest in? I know it depends on the goals but so many options to choose from. I ended up choosing these. What’s the formula to decide what to invest in?

- 25% – Vanguard Target Retirement 2040 Fund

- 25% – State Street Equity 500 Index Fund

- 25% – Vanguard Mid-Cap Index Fund

- 25% – Vanguard Small Cap Value Index Fund

Dear Sam,

First of all, a big congratulations to you for setting up your retirement investment. This is a critical step in your journey towards financial freedom. I will break down each of your questions here:

1. Any advice on how to choose funds to invest in? I know it depends on the goals but so many options to choose from.

You’re absolutely right, Sam. Choosing an investment fund or “manager selection” should be done after you decide on your goals; i.e., what are you investing for? Also, you need to know how long you have until you need the money, also known as your time-horizon. In this case, you already know that your goal is retirement. Since you are in your early forties, if you choose to retire at age 65, your retirement is about 20 years away. So, you have a 20-year time-horizon.

As a result of this long time-horizon, you can and should take maximum investment risk to maximize your returns. This means that most, if not all of your investments should be in stocks or equities, diversified across different markets.

Because you have a lot of financial risk in your company, you might tell me that you’re not that aggressive when it comes to your retirement investments and need some “sleep well” money. In that case, I would tell you to also have some high quality bonds like treasuries (government bonds) and high quality corporate bonds but not too much because you don’t want to lock in low returns just to feel safe.

Now that you have decided you’re going to keep most of your investments in stocks and a little in bonds, you need to find funds that reflect that allocation. Say you choose to keep 90% of your investments in stocks and the remaining 10% in bonds, you will need to find funds that reflect this stock/bond split.

2. I ended up choosing these. What’s the formula to decide what to invest in?

25% – Vanguard Target Retirement 2040 Fund

25% – State Street Equity 500 Index Fund

25% – Vanguard Mid-Cap Index Fund

25% – Vanguard Small Cap Value Index Fund

Now, let’s look at your investment choices. You might have thought that investing equally across each fund means that you’re diversified but that is not the case. The funds can represent different markets and hence, have different uses in your portfolio. So, you have to size them correctly, or you might be taking too much or too little risk and in some cases, duplicating your exposure. For example, the second fund in your list, the State Street Equity 500 Index Fund mirrors the S&P 500 index or the 500 largest US companies, whereas the last two funds, Vanguard Mid-Cap Index Fund and the Vanguard Small Cap Value index fund cover mid and small sized companies.

Large companies are more stable but small and mid-sized companies can provide higher returns and also more diversification. What is the right allocation across these markets? That depends on your asset allocation. We cover this topic extensively in my course. For now, know that the percentage of money you put in different funds depends on the risk and use of each fund. So, here are two solutions that you could pursue to get your 401K started.

Option 1: Choose the target-date fund and call it a day!

Your 401K plan’s administrator has made it really easy for you. You could just pick the first fund, Vanguard Target Retirement 2040 Fund and be done. This is a target date fund which means that it has the goal or target of investing for your retirement on a certain date. In this case, it is 2040.

Pro # 1: Outsource all the investment decisions to an expert

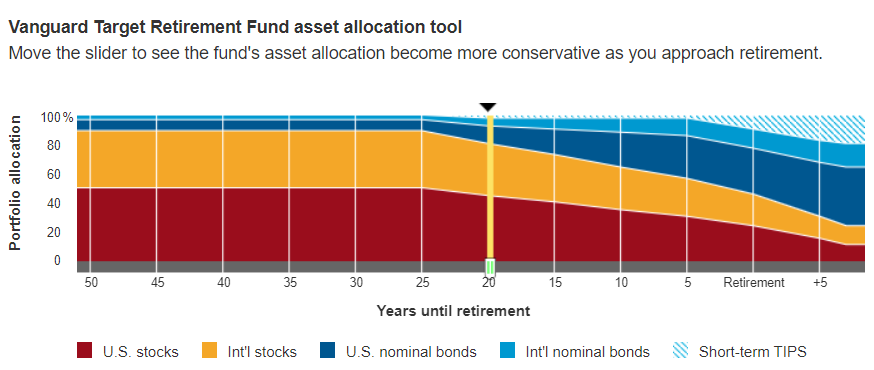

The neat thing about target-date funds is that you’ve left it to the experts to decide how much in stock vs. bonds you need to be in. You’ve also left it to them to decide on the funds to invest in. They will change this asset allocation for you as you age and as your time horizon changes, that is, they will shift your allocation from stocks and risky assets to bonds and more stable assets as you get closer to retirement. In fact, they will even manage your money after you reach retirement.

Pro # 2: Target date funds are backed by deep research

Target date funds have seen enormous growth of 101% in the last 5 years reaching $877 billion in assets as compared to 16.4% for other mutual funds.

Because of the huge revenue source that they represent, target date funds are top of minds for large investment companies. In my years of working with investment companies, I saw the amount of research that goes into assessing retirement income, target date fund asset allocation, glide path mapping and the overall retirement plan design. For this, investment companies hire not just investment professionals but also statisticians, data scientists, actuaries and a host of other experts.

Con: They are not customized for you

Even though target date fund allocations reflect a lot of research, it is not personalized to your goals and your risk tolerance. So, you might opt for a more customized solution. This is option # 2 below.

But first, let’s look at what’s really in your target date fund:

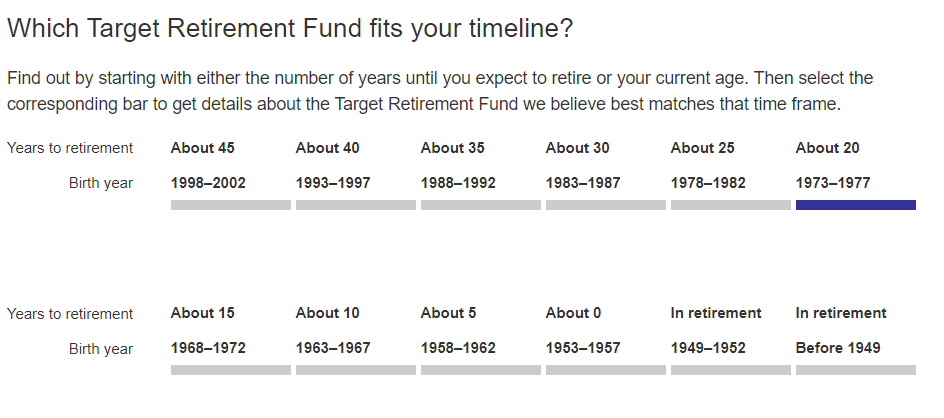

On your employer’s website where you make the investment choices, you should also have a place to get the portfolio information about the funds. As an example, you can simply google Vanguard target retirement plans and it will take you to this landing page on their target date funds.

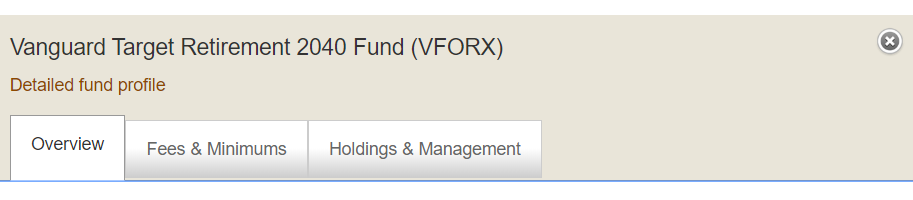

- Here, you can first select the years to retirement and your birth year. This will take you to the right target date fund for you, Vanguard Target Retirement 2040 Fund (VFORX)

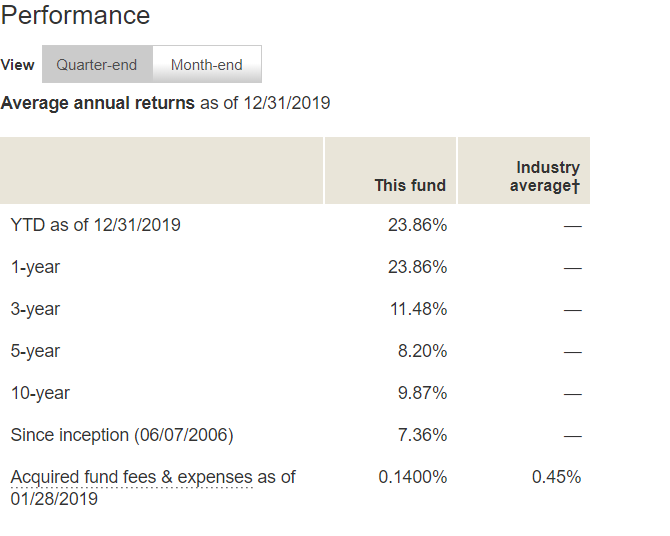

- Click on the fund “overview” and scroll down further, where you’ll see the fund performance and fee. The fund’s fee is .14% of the money you invest in it. If you put in $1,000, your fee will be $1.4 annually. This is a very low fee but your fee could be even lower depending on the rate your employer has negotiated with the target date fund provider

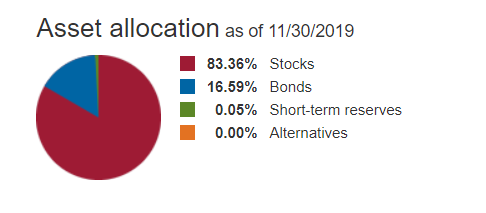

- Scroll down further and you’ll see the fund’s asset allocation. It is currently 83.36% in stocks and 16.59% in bonds.

- You can also see the glidepath underneath. This is the mapping of how your asset allocation will automatically change over the years. Notice how you start with a heavy stock allocation and low bond allocation and how that changes over time

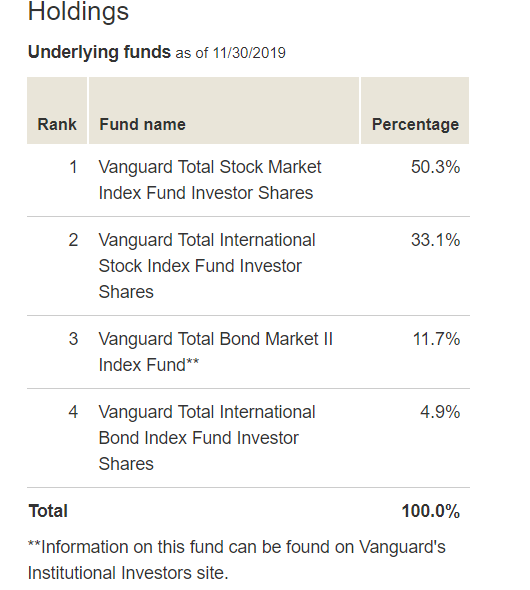

- Lastly, click on the Holdings and Management tab. Here you can see the underlying mutual funds, the target date fund invests in. Notice that it is invested in 4 different Vanguard index funds

Option 2: Customize it for yourself

If you want to take more risk and if you have a sizable 401K, you could customize it further for yourself.

From looking at the target date fund, we know that 83% of its portfolio is in stocks. But, we determined earlier that your asset allocation should actually be 90% in stocks. A simple way of getting your portfolio to reflect your asset allocation would be to add just enough of another stock fund to bring the total stock allocation to 90%.

You could simply add the State Street Equity 500 Index Fund. By doing a simple back-of-the-envelope calculation, we can solve to get a 90% equity allocation and that would mean allocating about 40% to the S&P 500 index fund and the remaining 60% to the target date fund. Here’s how the final allocation looks:

- 60% – Vanguard Target Retirement 2040 Fund

- 40% – State Street Equity 500 Index Fund

- Your overall allocation: 90% stocks and 10% bonds

My suggestion:

If I were doing this myself, I would go for option 1 and simply invest 100% of my 401K in the target date fund.

Reason 1: If you go for option 2 and do it yourself, you would also have to change the percentages of the funds around as time goes because the asset allocation of the target date fund will change. Knowing that you’re a busy professional who has a business to run, it would be far easier to let a team of experts manage this for you. This will ensure that your retirement money is invested as it should be, all the time.

Reason 2: As you saw, the target date fund is diversified across 4 different funds already and it also has allocation to US stocks. By adding another US stock fund, you’re diluting the diversification benefits of the 4 funds.

Reason 3: The target date fund has less stocks than you would ideally like but it’s a difference of only about 7%. Given all the benefits of a target date fund we discussed above, this is a small difference and the benefits outweigh the cost.

Do you have any investment or personal finance question that you’d like for me to answer? Send me your questions below:

DISCLAIMER: This site exists to thought provoke and learn from the community. Your decisions are yours alone and we are in no way responsible for your actions. Please think long and hard before taking and financial decisions. Please be advised that nothing on this site constitutes tax advice.

Leave a Reply

Want to join the discussion?Feel free to contribute!