My 401K is tanking. What should I do?

Roshani Pandey is a financial advisor and founder of True Root Financial. True Root Financial is located in San Francisco, CA and serves clients across the globe.

A regular reader of this blog writes:

Hi Roshani,

My 401K is tanking. How should I handle it at a time of this bear market? Should I sell now? Buy more? What about monthly contributions – do I keep contributing? Do I reallocate assets?

Hope you are staying safe in these uncertain times. I read your articles often. You’re doing a great job. Keep it up!

Best, Ron

If you have a question of your own, contact me here to speak with me one on one.

Dear Ron,

Thank you for your kind words. A challenging time can test us but it can also be an opportunity for great personal growth. This is because challenging times reveal the impermanence of everything.

With a global pandemic and a global shutdown, it seems like today, the times are so uncertain. But in reality, it’s always been uncertain. Even when the market was making new highs and the economy was sailing smoothly only a few months ago, last February. The risk back then was how high it would go until something went wrong. And now, the risk is how bad this will get before it comes back up.

In fact, just like our lives, the economy and the stock market also move in a wave like motion, spiraling up and down through highs and lows – peaks and valleys. As individuals, we get so consumed with what’s happening at the time that we lose sight of the full picture. But once we embrace this uncertainty and these ups and downs of our journey, we are able to see the full picture and make better investment and life decisions.

So, let’s start with this question that’s on everyone’s mind.

Question 1: Should I buy more or sell?

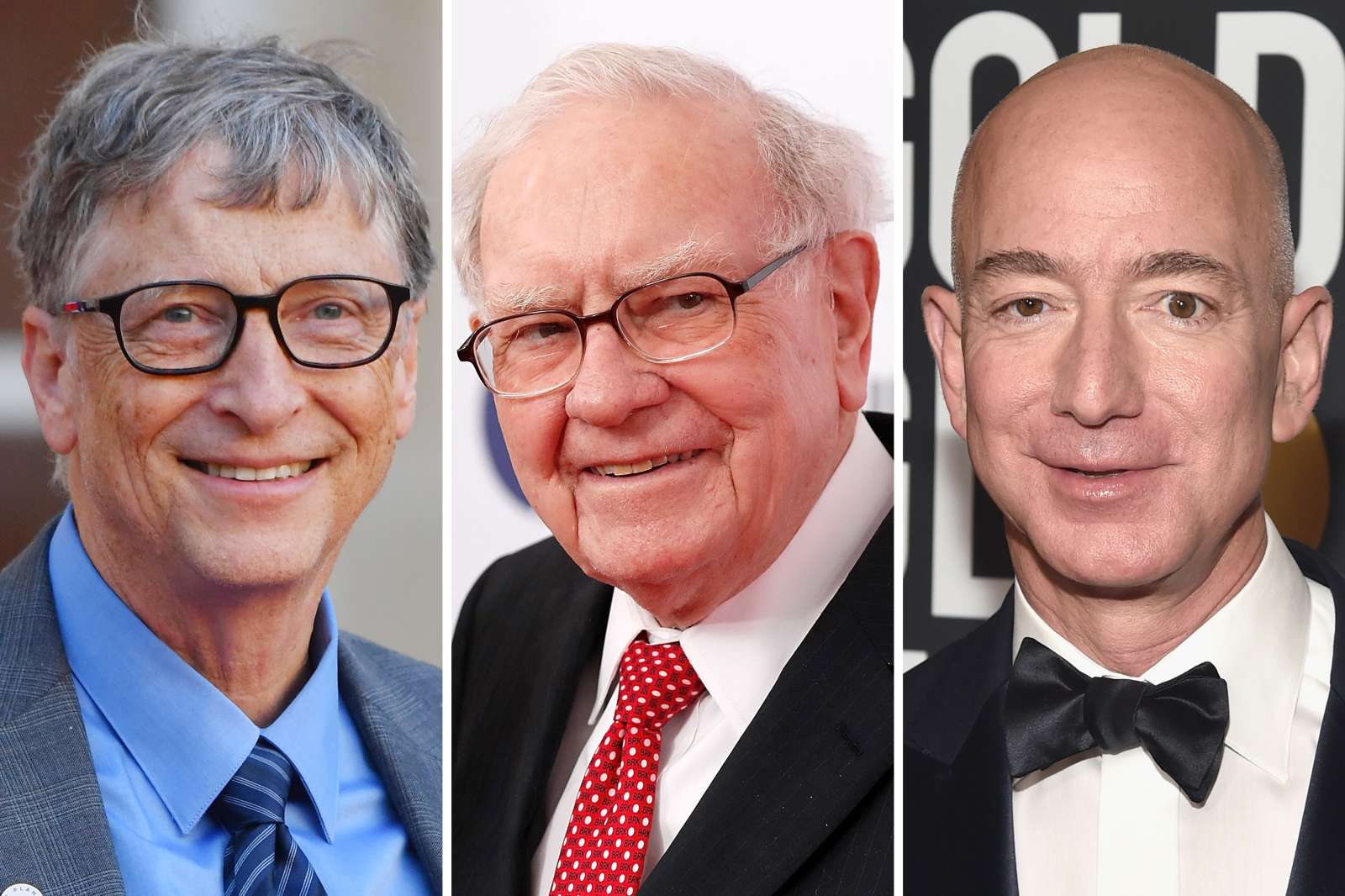

Warren Buffett says “be greedy when others are fearful.” In other words, buy when everyone else is selling from fear and panic. This may seem like the perfect time to do so because like you, many other people’s 401K are also tanking. But the problem with applying Buffett’s sage advice is that in the current scenario, not everyone is fearful. Some like the oil market participants are really fearful and some like the stock market participants not so much.

The oil futures contracts expiring in May turned negative for the first time in history. An oil futures contract is an agreement between a buyer and seller to buy oil at a predetermined date and price. Commodities like oil are largely dependent on supply and demand. When the supply is robust but the demand is close to zero due to a global shutdown and the ensuing economic slowdown, the price of oil craters like it did. The weak demand for oil tells us that the oil market anticipates a prolonged slowdown in the economy.

On the other hand, the S&P 500 is up +27% from its March low and is now down only about -12% for the year. This is in sharp contrast to the crude oil index (S&P GSCI Crude oil), which is down about -64% for the year.

Of course, not all sectors and industries in the S&P 500 are advancing and even technology shares that were advancing have retreated a bit after their earnings have shown that no company is completely immune to the pandemic fallout.

But, it does seem like the stock market expects a faster recovery than the oil market. Who will be correct? Depends on many factors, such as how long the lockdown will last. How fast the vaccine will be here? And how many businesses will survive in the meantime? We don’t have clarity on any of this, yet.

Stocks are not cheap

The S&P forward price/earnings ratio, which is a gauge for how expensive stocks are, is currently at around 20, which is higher than its most recent five-year historical average of 16.7. So, by historical standards, stocks are not cheap. Can they get cheaper? Perhaps but that means the price/earnings ratio needs to decline another 25%. If that will happen or not, again depends on many questions about the economy and businesses that we don’t know right now.

So, there is no clear cut answer to the question should I sell or buy right now because at the heart of it, the question is asking about timing. And as I have said time and again, it is extremely difficult, if not impossible to time the market.

Investors who try to do that often end up performing worse than the market. Stock prices adjust to forward looking information, not historical information. As a result, stock market performance typically precedes that of the economy. So, by the time our questions are answered, it will be too late for an average investor to act. If the news about the economy turns out to be better than expected, stocks will already be expensive. And by the time mass panic and paranoia seeps in, large investors will have already dumped stocks and they will already be cheaper.

So, instead of trying to time the market, a better use of our time is to stay invested and to focus on creating a diversified portfolio that takes into account the inherent risks and uncertainty of the market. This brings me to your other question.

Question 2: How should I handle my 401K at a time of this bear market?

Personal growth as individuals and investors is possible when we can impartially assess the situation and our actions in it. So, while your 401K is tanking, use this time to assess your portfolio and ask yourself these questions:

1. Was your portfolio built for the long-term?

I hope that when you created your 401K portfolio, you created a diversified portfolio taking into account the long-term risks and returns of your investments. Long-term risks and returns are based on your expectations over the next 7 or 10 years or longer.

It is not based on what will happen in the next few months or the next year. This doesn’t mean that you can’t express your short-term views on the market but these moves should be measured and monitored. In other words, they shouldn’t be the bulk of your portfolio and they shouldn’t be permanent.

If you did this, then you should be on the right track. Even if your portfolio is down now, since your underlying assumptions took the uncertainties and the ups and downs in the cycle into account, it stands to reason that your portfolio will also recover.

If on the other hand, you built a portfolio that was not diversified and was based on what you thought was going to happen in the next few months or next year, your expectations could be completely off. Your losses may be concentrated and it might take a long time to recover.

2. Did the portfolio take into account your risk tolerance?

Besides taking long-term risks and returns into account, your portfolio should also be built around your personal goals and risk tolerance. If you are thinking of selling your portfolio because it’s too volatile or if you can’t sleep at nights thinking what may happen, you may have built a portfolio that’s much riskier than your risk tolerance. So, take this time to assess your risk tolerance. If necessary, add some high quality bonds to your portfolio.

3. Do you need expert help?

If you do not have the wherewithal to manage your portfolio, you could seek help from a financial advisor or at the very least, a target date fund to help you invest your 401K.

A target date fund is an inexpensive and easy way to invest your retirement money with professional help. They will also automatically adjust the portfolio for you as you near retirement. Typically, target date funds will be one of the investment options available in your 401K lineup.

A financial advisor can oversee your entire financial picture and help you plan your retirement.

Question 3: What about monthly contribution? Do I keep contributing or stop?

Contributing steadily to your 401K even when it is tanking, is generally a good idea because you buy at different prices and dollar cost average in. However, consider your personal situation before deciding how much to contribute:

If you have a steady income and a stable job, definitely keep contributing.

If you don’t feel so secure about your job and the rest of your finances are not very stable, consider decreasing your contribution to the point where your employer still matches your contribution. Then keep the extra cash as your emergency fund for when you may lose your job or your income dwindles.

Question 4: Do I reallocate assets?

When faced with a downturn and a tanking 401K, many investors start dumping poorly performing assets and move into high performing ones, locking their losses and buying expensive shares. This is the reason why it’s so important to diversify the portfolio in the first place. But even when your portfolio is diversified, it may not be unscathed when faced with a large economic downturn like the Coronavirus pandemic. This is because no matter how much you diversify, you can never diversify away the systematic risk that comes from investing in the market.

If your portfolio was diversified to begin with, then use this downturn to rebalance your portfolio. Rebalancing means that you sell the assets that have risen in value and buy the ones that have gone down. This way, you are buying low and selling high, while bringing your portfolio in line with your goals.

Additionally, if you find out that the current portfolio is not right for you because it does not capture your risk tolerance or if it’s not diversified enough, then consider reallocating to bring your portfolio in line with your needs. To avoid selling at the bottom, you could do this gradually by re-investing the dividends.

Leave a Reply

Want to join the discussion?Feel free to contribute!