What happens to your tax liability with proper financial planning?

Roshani Pandey is a financial advisor and founder of True Root Financial. True Root Financial is located in San Francisco, CA and serves clients across the globe.

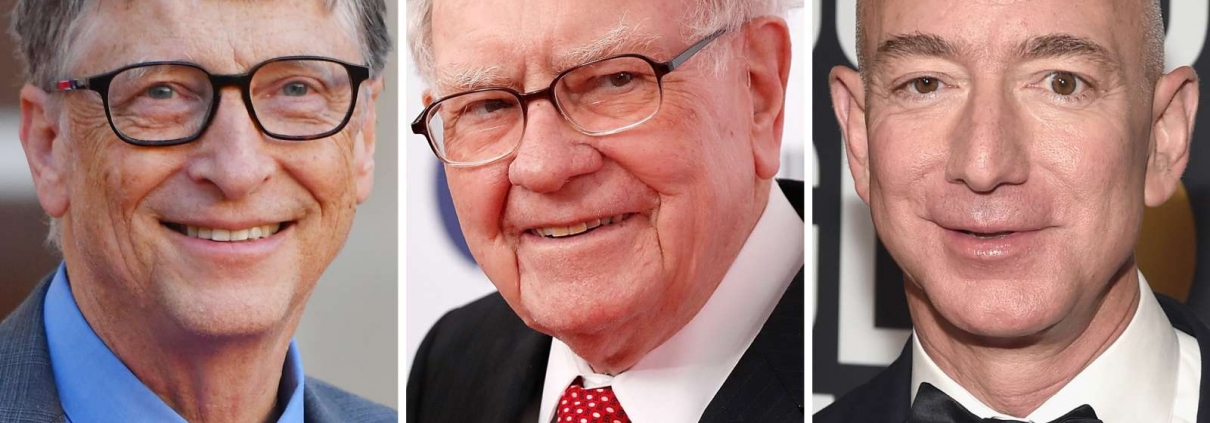

According to an investigation by ProPublica, “in 2007, Jeff Bezos, then a multibillionaire and now the world’s richest man, did not pay a penny in federal income taxes. He achieved the feat again in 2011.” In fact, from 2014 to 2018, as his wealth skyrocketed to $99 billion, his tax as a percentage of his wealth was only 0.98%.

Bezos is not the only mega-billionaire to have done this. Warren Buffet paid even less compared to his total wealth growth. See the full list below.

This is what happens to your tax liability with proper financial planning. While most of us might not be able to duplicate what Bezos and Buffet did, we can certainly minimize our tax liability with proper planning. In this article, we will discuss how they were able to do this and how you can also take charge of your personal finances and reduce your true tax rate like the mega billionaires.

Source: ProPublica

What happens to your tax liability with proper financial planning

As you can see in the above graphic, even as the wealth of each billionaire grew astronomically, their total income reported stayed at a fraction of the wealth growth. This is the primary reason why each billionaire was able to get away with paying a much lower tax than their actual wealth growth.

The IRS only recognizes your total taxable income when calculating your tax liability. So, reducing your taxable income is key to also reducing your tax liability. Reducing your taxable income is also key to reducing other forms of taxes such as capital gains and state taxes. Your taxable income dictates your long-term capital gains tax bracket as well as local tax rates. Here are some ways in which financial planning can help reduce your total taxable income:

1. Investing

We have written extensively about how shifting your wealth from earned income to investments can shield a lot of it from a tax burden. The key to doing this is to invest in assets such as stocks where your profit is kept as unrealized gains rather than distributed to you as income.

2. Using the right retirement account

One of the most interesting examples of avoiding tax comes from ProPublica’s investigation of Paypal Founder, Peter Thiel. According to this investigation, “Thiel has taken a retirement account worth less than $2,000 in 1999 and spun it into a $5 billion windfall.”

The way he did this was by buying huge chunks of shares of early start-up companies in his Roth account. Once in a Roth, the investment grows tax-free. You can even pass it to your heirs tax-free. As Thiel’s investments in these early startups skyrocketed, they did so tax-free as a result of being in a Roth account.

While a Roth account can lower your future tax, it does not lower your current tax. Hence, for those that have a high income currently, you need to lower your current taxable income, not your future taxable income. Here are some tax-deferred vehicles that can help reduce your current taxable income:

-

Maximize your 401K contribution

The maximum 401K contribution for 2022 is now $20,500. Maximizing your 401K contribution means that your taxable income is lower by that amount. This means the tax you pay on your current income is also lower as a result.

Additionally, it is not enough to just contribute to a 401K; pay attention to how it is being managed. As you advance in your career, your 401K can become a major part of your total wealth.

So, ask yourself, is your 401K being optimized to your investment time horizon? Are you taking advantage of the investment options available to you? Are you monitoring it and making changes as appropriate? If not, a financial planner can help you review these investments and optimize it to fit your goals.

-

Use a solo 401K

For those that are self-employed or on a 1099 income such as doctors, realtors or contractors of any kind, a solo 401K can greatly minimize your taxable income and provide a tax-efficient way to save and invest. A solo 401K allows you to contribute up to $61,000 of your income in 2022.

Most solo 401K plans can also accommodate a Roth 401K option, providing diverse ways to save. If you’re not able to open a solo 401K, a SEP IRA can also provide similar benefits.

-

Amplify your savings with a Cash balance pension

If you are a business owner and are looking to lower your taxable income, you should definitely explore a cash balance pension, in addition to a 401K. A cash balance pension plan allows you to shield an outsized amount of income. However, it also comes at the cost of having to establish the plan and many other variables. A financial advisor can help you analyze the benefits and costs and make a decision.

3. Charity

Warren Buffet and Bill Gates are both famous for pledging more than 99% of their assets to charity. The tax code generally rewards being charitable but not always. So, planning your charitable giving is important not just to get the most tax benefit but also to make sure the charity benefits most from your gifts.

-

Donate with stock gifts rather than cash

Instead of selling shares and gifting the proceeds to charity, gift the appreciated stock itself. This way you avoid the capital gains on the stock sale and also get a tax deduction for the gift of up to 30% of your adjusted gross income (AGI).

-

Concentrate big charitable gifts and time it carefully

You might be in a year where your income goes up a lot due to a Roth conversion, or due to equity compensation being vested or because your business is flourishing. If you are in such a year, concentrate your charitable giving to that year rather than spreading it across several years. This gives you the highest amount of tax deduction for those charitable donations.

If your capital gains go up instead due to sale of a business or a stock option exercise, you can still benefit from concentrating your charitable gifts. You might not have decided which cause or organization to donate to and this is where a donor-advised fund can really help you. Ask a financial advisor how to open one.

Importance of ongoing planning

Tax planning is most effective when it is ongoing and not just a one-off conversation at yearend or just before you file your taxes. This is where a financial advisor, who you meet with periodically and who knows your full financial picture can really help. If you would like to understand how working with a financial advisor can benefit you, please book an introductory call below:

Leave a Reply

Want to join the discussion?Feel free to contribute!