How to get into the stock market? Is now a good time to invest?

Roshani Pandey is a financial advisor and founder of True Root Financial. True Root Financial is located in San Francisco, CA and serves clients across the globe.

Summary:

- If you have cash in the sidelines today, you might be wondering how do I get into the stock market. Is it too late for me? Is now a good time?

- First, acknowledge that it will never feel like it’s a good time to invest; trying to time the market to buy low and sell high is very difficult, if not impossible

- Once you decide to invest, the next question is should you invest all at once or over time. Research shows that it’s better to invest all at once

- However, first time investors or those investing a large amount of money might be understandably concerned. So, an alternative might be to invest over a short period of time and to automate the process

Is now a good time to invest?

In 2006, Anna bought her first house. It was a modest 1-bedroom condo but it was hers. She had saved enough for a down payment and closing cost and when the settlement agent handed her the home keys, it felt like the day had suddenly become brighter. Being a first-time homebuyer, she did not know much and was told that she was buying at a low. To be fair, home prices had softened from their 2005 highs. Two years later, the housing crisis hit that turned into a credit crisis that turned into a full blown global financial crisis and a great recession.

Like most people in the US, her home value went down almost 30%. She concluded that her timing was bad and timing was everything when it came to investing.

She was so down on home-buying at the time that she did not see an opportunity that was staring at her in the face. That opportunity was buying another home, as prices plummeted and loan foreclosures skyrocketed to 186%.

Fast forward to 2020, Anna has put the housing collapse behind her. She is now ready to invest in real estate again but she feels she missed the opportunity of a lifetime in the wake of the financial crisis. And now the houses are too expensive. She’s waiting for home prices to come down but it might never happen or happen to the extent she’s hoping for. And even if it does, she might be gun-shy again as she hears alarm bells ringing from pundits about a housing market collapse and a possible recession.

While buying houses is not necessarily the same as investing in the stock market, we can see the parallels. It is always scary to get your money invested. It just never feels like it’s the right time.

Buy low, sell high

We all know this truism but how easy is it to practice? Very difficult. This is because none of us can tell with certainty if we are now at the low or high. We only know this in hindsight. So, when the stock market is doing well, we worry if we are buying at the high and if a recession is around the corner. When the stock market is at a low, we worry that things might get worse.

Take now for example. We just came off of 2019, a solid year for the stock market with returns of almost 30%. The market is still at an all time high. If you were to put money to work today, you would understandably be worried. This is the eleventh year since the Great Recession. That’s the longest the US has gone without a recession. That means that we are long overdue for one, as all cyclical economies like the US go through the cycles of boom and bust. Then, there are other external risks like the threat of a disease like the Coronavirus, or any missteps in US foreign policy, or the 2020 presidential elections.

But these risks won’t go away even when the stock market is at its lows. During the last big low we saw in the earlier months of 2009, just like Anna, most were hesitant to put their money into the market as they waited to see how low it could go. Even long after the bottom in March, 2009, many were hesitant to put money back in as mass paranoia and pessimism set in.

Hence, trying to time the market to buy exactly at the low and sell exactly at the high is very difficult, if not impossible because the future is unknown. This is the fundamental risk of investing – the unknown future. To lessen the impact of the unknown future, we build our asset allocation and we diversify the portfolio and instead of trying to time the market, we stay invested.

If you are ready to start investing, the next question is should you invest all at once in a lump sum or play it safe and space it out?

Case for investing all at once in a lump sum

You immediately start compounding your returns. As I have said before, this is a powerful force. In most years, stocks and bonds have outperformed cash. Since the financial crisis, the interest rates of most developed economies have been near zero. So, staying in cash will not even keep up with inflation. Investing in stocks on the other hand, means that your money is working.

Case for investing over time

Many investors will not be comfortable investing all at once. There are many ways of investing over time and one popular way is investing a fixed amount of money over time, also known as dollar cost averaging (DCA). For example, if you wanted to invest $10,000 in Apple shares, you dollar cost average in by investing $2,000 every Friday, instead of buying $10,000 of shares, all at once.

The biggest benefit of this approach is the psychological comfort it gives you as a result of the sense of control over the process. In the above example, if the price of Apple goes down in subsequent weeks, you also get a lower price.

So, which approach is better? The winner is…

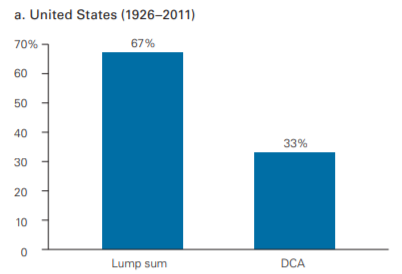

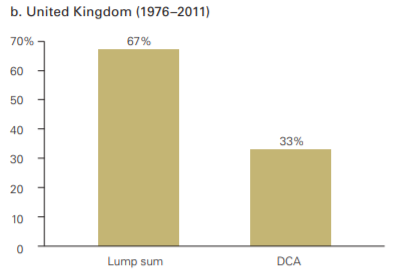

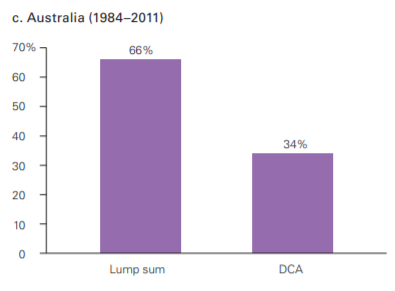

In 2012, Vanguard published a research report, examining the results of investing lump sum versus dollar cost averaging in. They examined this across different time periods as well as different countries: the US, the UK and Australia. The results are strikingly similar across different countries and time periods. A portfolio that was invested in lump sum performed better than one invested using dollar cost averaging two-thirds of the time.

Vanguard repeated this research across different asset allocations and different time span for dollar cost averaging like over 6 months, 12 months, etc. and the results were unanimously in favor of a lump sum approach. This supports various other research that shows that in general, the lump sum approach outperforms investing over time.

Source: Vanguard

Why does lump sum outperform dollar cost averaging?

1. Markets are generally going up

Historically, even though there have been periods where markets are down, the general course of the market is up. This means that the longer you wait, you actually end up buying at a higher price.

2. Cash drag

As you invest the money over time, part of it will sit in cash earning nothing. So, the portfolio that is invested over time performs worse in a rising market.

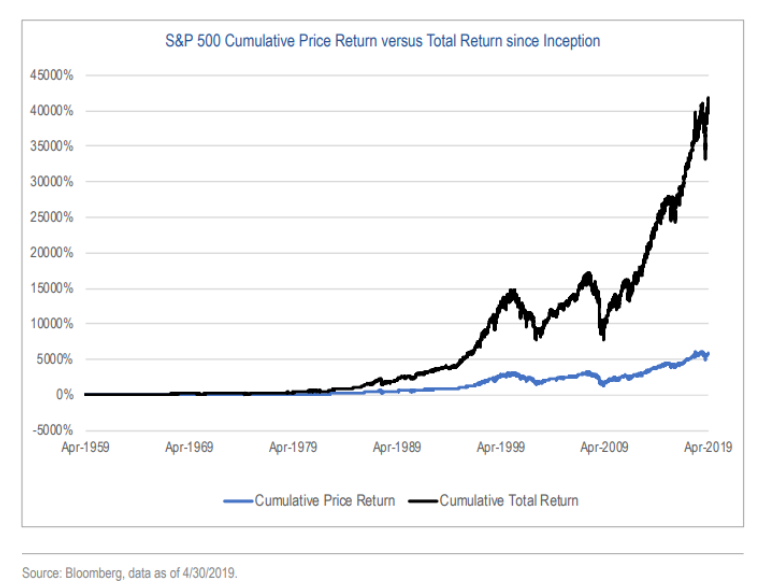

3. You miss out on dividends and compound returns

Dollar cost averaging is too focused on price and could miss the bigger picture. The bigger picture is that even though you might be able to buy a stock at a lower price by waiting, you miss all the dividends and compounding of the dividends by reinvesting it. We can easily see this when we compare the price return of the S&P with its total return. The price return simply looks at the change in price, whereas total return on the other hand assumes that the dividends are reinvested over time. From 1959 to 2019, the price return of the S&P was close to 5,000% but the total return is upwards of 40,000%.

Does Dollar cost averaging ever work?

Yes, it works when the markets are going down. Even in the example above with Vanguard, they worked about a third of the time. However, these periods are rare.

Furthermore, by delaying investing and staying in cash, you are in essence altering your asset allocation. For example, if your asset allocation was 100% stock, by putting only half of the money into stocks and keeping the other half in cash, your asset allocation is now 50% stock, 50% cash.

So, if you are comfortable with your asset allocation, which should take into account your goals, time horizon and risk appetite, there should be no reason to delay investing. If you are in fact, not comfortable with the level of risk, then perhaps you need to change your asset allocation.

So, how should you get into the stock market?

- First acknowledge that it will never feel like it’s the right time to invest

- Market timing is very difficult, if not impossible

- Research shows that it’s generally better to invest in lump sum than over time

- If you are new to investing or investing a large sum, regardless of what research shows, it will understandably be hard to invest all your hard earned money at once

- If you are in such a position, an alternative could be to invest over a short period, for example in three tranches, one tranche a week. This way, if the market goes down, you get a better price in the later tranches. If the market goes up, at least you invested the previous tranches at a lower price

- However you decide to space out the investments, see if you can automate it so the money gets invested as scheduled and you don’t drag your feet when the time comes. If you have an advisor, give them orders ahead of time, to invest on the scheduled dates

Lastly, know that the uncertainty you feel before putting your money to work will not go away just by delaying investing. You will experience the same uncertainty and highs and lows once the money is invested. In fact, it’s this uncertainty that the market pays you for, also know as the risk premium. So, as long as you have built a diversified portfolio around your asset allocation, that takes your goals, your time horizon and your risk tolerance into account, these uncertainties are just par for the course.

Leave a Reply

Want to join the discussion?Feel free to contribute!