Investing for beginners: How do I start investing?

Roshani Pandey is a financial advisor and founder of True Root Financial. True Root Financial is located in San Francisco, CA and serves clients across the globe.

Recently, I received the following message from my friend, Larissa. In talking to people about investing, this is a recurring theme I hear from many. In providing an answer to her, I will provide a guide to investing for beginners.

If you have an investment question of your own, please write to me here or sign up for a free consultation here.

Question

Hi Roshani,

I have been reading your articles on investing and learning a lot. You know how scared I’ve been of the stock market because of how my ex husband gambled away all my money on bad investments.

I think I’m finally ready to start investing. But, where should I begin? Because of what happened, I feel that I have very poor luck when it comes to investing and I’m afraid of making the same mistake again.

Dear Larissa,

Let me tell you something that I tell myself when something bad happens: you are not what happens to you. Just because someone disrespects you, doesn’t mean you’re disrespectable. Just because someone breaks your trust, doesn’t mean your trust is not precious. And just because your ex lost your money by “gambling away on bad investments” doesn’t mean YOU have poor luck in investing. These are events and accidents that can happen to anyone. Very often, they have little to do with us. But to make sense of what happened, we tell ourselves these stories. Change the story you tell yourself and it will change your life.

Now, I am not sure what exactly your ex husband invested in but I sense a lot of fear and hesitation in your question. Let me address that first.

“I am scared of investing in the stock market”

When people use the word “market” to mean capital markets, they are just referring to the stock market. But the actual capital markets are much bigger than just the stock market.

Capital markets explained

The capital market is where people who have money and people who need the money, come together. Those who need money consist mainly of governments and corporations, who issue stocks and bonds to raise the money they need to run the government or to expand their business.

A government like the United States government raises the money it needs by taking loans from investors by issuing treasury bonds. Companies raise the money they need to run their business by issuing stocks and bonds. When you buy a stock, you own a piece of a company. When you buy a bond, you are loaning money out, for which you get interest and the money back at the end of the loan term.

On the other side of the capital markets are people who have the money to invest. They consist of individual investors like you and me and institutional investors like pension funds, governments around the world, insurance companies, endowments and foundations.

According to a research from McKinsey & Co., institutional investors invested more than $88.5 trillion at the end of 2017. That figure is more than 4 times the size of the US economy, the largest in the world, with a size of over $20.5 trillion.

If you look at the sheer numbers, the markets are much bigger than you or me. Our money is not even a drop in the huge ocean that is the market. Its key players are large institutional behemoths like the California Public Employees Retirement System (CalPERS) with approximately $326 billion in assets. It includes sovereign wealth funds like Abu Dabi Investment Authority (ADIA) with $694 billion and China Investment Corporation (CIC) with $670 billion in assets.

CalPERS invests in the capital markets to be able to pay its pensioners. ADIA and CIC invest to grow their resources for the state’s use.

If you are worried about losing your money, can you imagine how worried CalPERS is about losing theirs? Or, ADIA and CIC are about losing theirs? Of course, these entities have very deep investment resources but make no mistake, the reason why they invest in the capital markets is because they have a fundamental faith in it. That it is not a gamble. It is not a lottery.

This brings me to another word you mentioned, “gamble.” Many people shy away from investing because they think it’s a gamble.

Investing in the market is not a gamble

Gambling is a zero-sum game. Gambling simply equates to money being transferred from the loser to the winner. There’s no value created. Whereas the stock market represents an enormous value that is being created. By you investing in a stock, you are giving capital to a company to grow. In return, you get to own a piece of the company. As the company grows, the value of your stock also grows.

The reason why some people think of it as gambling is because of the price fluctuations they see on TV every day. Buying and selling to capture a quick profit from these changes might seem like gambling.

In the short-run, many factors affect stock prices. This is market noise. Over the long-term, stock price represents a company’s earnings. The overall stock market represents the earnings of many companies and in turn the economy. As the economy does well, so do stocks. When you invest in US stocks, you are actually investing in the US economy. When you invest in world stocks, you’re actually investing in the world economy.

There’s no limit as to how high stock prices can really go – precisely because it’s not a gamble where the prize is limited. It’s an unlimited pie, that can potentially keep expanding. The world economy as measured by the world gross domestic product (GDP), has risen most years from 1961 through 2018. Many economists expect the world economy to keep expanding as populations rise and more emerging economies like India and China continue to produce and consume more.

Investing requires risk management

But what happens if the world economy shrinks like it did in 2009? If that happens, the market will also decline. These losses can be dramatic. But, does that mean that the market will cease to exist? That all stocks will lose value to never come back up again?

At the time of writing this article, this all seems very unlikely to happen but we don’t know the future and history is not always a blueprint for what’s to come.

So, what should we do given that there are so many benefits to investing but also risks? Invest but manage the risks. To manage the risks, you have to first find the right asset allocation for you and second, diversify your investments. We will discuss this below.

“I am finally ready to invest but where should I begin? “

Before I talk about the steps to get invested, let’s first discuss what you want to invest. If you want to invest an employer provided retirement plan like a 401K, your employer should have already narrowed down your choices for you. Read my article about how to pick investments in your 401K.

If you are referring to money outside your employer provided retirement plan, then you could hire an advisor to do it for you. Read my article about how to pick the right advisor. Managing your investments by yourself is also an option, but given how inexpensive it has become to hire an advisor, you might want to find one.

If you decide to invest yourself, here are 4 easy steps to get started:

Step 1: Assess your goal

Are you investing for retirement or to buy a house or just investing your savings? Your goal determines two things.

- First, it determines if your goal is even feasible. Say, you want to buy a million dollar house in 10 years but only have $500,000 today. Unless you’re planning to add money, it may not be feasible by just investing in the market. To assess the feasibility of your goal, you can simply google search a free investment calculator

- The second thing your goal determines is your time horizon, that is when you need the money

For simplicity, let’s assume that your goal is to invest the savings that you won’t need until you stop working, which you think will be when you’re about 65 years old. Let’s also assume you’re 35 years old now. This means that you have 30 years to invest the money until you need it. Perhaps you will never need this money and can pass to your kids. In this case too, it means that you have a very long time horizon of over 30 years.

Step 2: Assess your risk appetite

Ask yourself how much risk you are willing to take. Are you someone who is pretty aggressive or risk averse? You might think you can stomach a lot of risks but it might not necessarily be true when you see your portfolio going on a free fall. During the financial crisis, the markets lost almost 40%, would this have made you sell, do nothing or invest more? If your answer was to sell, you might be more risk averse. Put yourself in different scenarios and see what your answer would be.

Step 3: Find your asset allocation

Now, take everything you learned from step 1 and 2 and create your asset allocation. Your asset allocation is the blueprint for your portfolio. On the most basic level, it answers how much you should invest in stocks vs. bonds.

As we discussed above, a bond is a loan and stock is ownership. A bond is safer than a stock in the sense that you are “promised” a certain interest and your money back at some point. With a stock investment on the other hand, there are no promises. Just like a business owner takes the risk that his/her business might go belly up, you as a stockholder take the risk that your investment might also completely lose value. Now, on the flip side, if your business becomes wildly successful, you as a bondholder still make the same interest but as a stockholder, your return is unlimited.

A stock is your gas pedal and a bond is your brake

You invest in stocks to grow your portfolio and in bonds primarily to protect it when the markets are down. The longer your time horizon, the more stocks you should buy and the shorter the time horizon, the more bonds you need. This is because the longer you don’t need the money, the more time you have to compound your returns. Even if there’s a recession along the way, you have time to recover from it. The shorter your time horizon, the more conservative you need to be because you don’t have the luxury of time, in case there’s a downturn.

In the above example, we assumed that you have a long time horizon of 30 years. This means that you should be primarily in stocks. Now, let’s assume that after assessing your risk appetite, you decided that you are also a bit risk-averse. So, a possible allocation could be an 80% stock and 20% bond allocation.

To find your asset allocation, you can also use any of the free tools available online. Try using ones provided by Vanguard or Fidelity. They will use the same steps we have discussed above but because they have different assumptions, they might give you different results. However, this will give you an idea of where you need to be.

Step 4: Implement your asset allocation

For the 80% of your money that you decided to invest in stocks, you could simply buy a S&P 500 index fund. The S&P 500 index consists of 500 largest US stocks. That’s instant diversification and exposure to 500 different stocks, just by buying one stock. It also captures 82% of the US stock market and represents over 11 different sectors and 69 different industries.

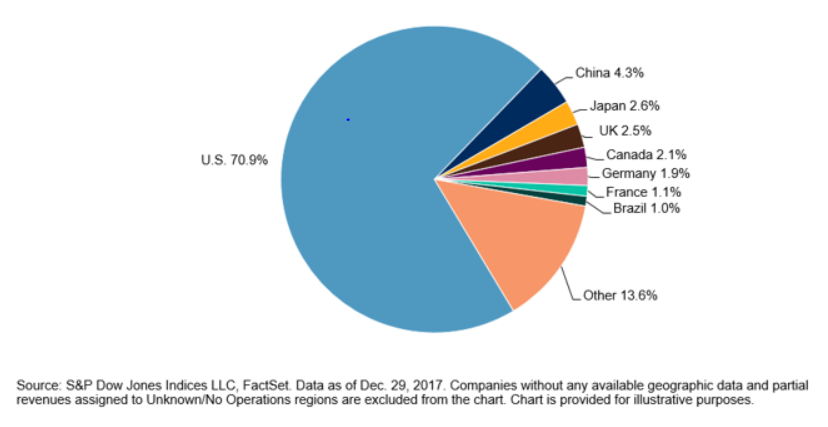

Even though the S&P 500 index represents only companies based in the US, it gives you an international exposure. According to the chart below from S&P, about 30% of the companies’ revenue comes from outside the US with 4.3% from China, 2.6% from Japan, 2.5% from the UK and so on.

For the 20% in bonds, you could buy the Barclays Aggregate index. Just like the S&P gives you exposure to a broad swath of US stocks, the Barclays Aggregate index gives you exposure to a broad range of US investment-grade bonds.

Next steps

To invest in the S&P 500 index fund and Barclays Aggregate index fund, you could simply open a brokerage account and buy the index ETF. Many firms offer a free brokerage account and you also pay zero commissions on ETF trades. Start by looking into Fidelity, Vanguard and TD Ameritrade to name a few.

Larissa, I really applaud your decision to start investing. Move forward with eyes open, but without any fear. “The only thing to fear is fear itself.”

I wish you all the best!

Leave a Reply

Want to join the discussion?Feel free to contribute!